A world of data translated into meaningful and actionable information.

Empowering you to make better decisions each and every day is the CAB difference.

Make Better Decisions Providing cutting edge industry-leading products

for in-depth motor carrier analysis.

-

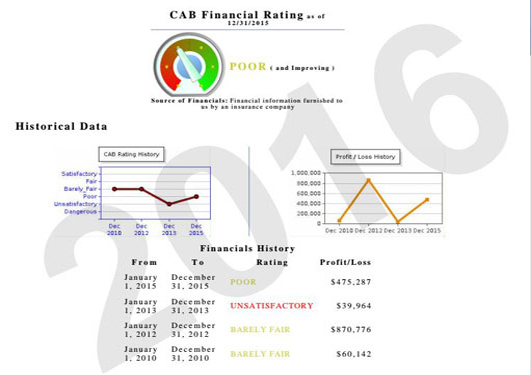

Financial AnalysisThe CAB Rating and Financial Analysis has been provided exclusively by us for over 75 years.

Financial AnalysisThe CAB Rating and Financial Analysis has been provided exclusively by us for over 75 years.

-

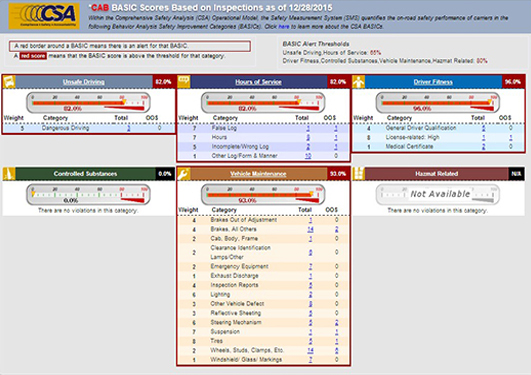

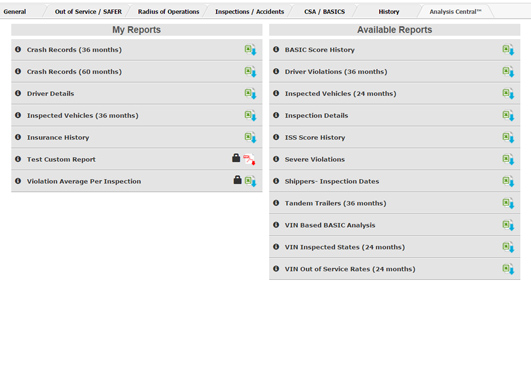

Motor Carrier ReportsOur reports are the accepted industry standard, offering the most advanced and comprehensive analysis available. The user-friendly layout, interactive capabilities and focus on highlighting relevant issues are critical to making informed decisions.

Motor Carrier ReportsOur reports are the accepted industry standard, offering the most advanced and comprehensive analysis available. The user-friendly layout, interactive capabilities and focus on highlighting relevant issues are critical to making informed decisions.

-

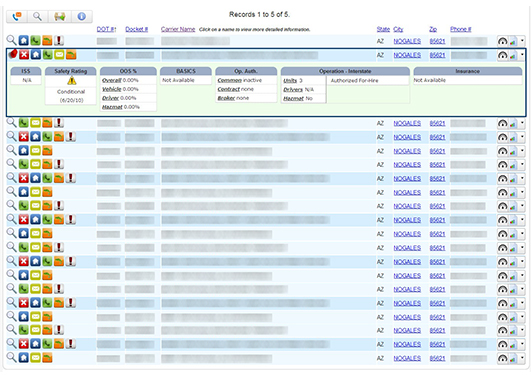

Chameleon DetectorOur proprietary and multi-point matching algorithms allow even the most basic user to understand the relationships and potential fraud exhibited by Chameleon Carriers.

Chameleon DetectorOur proprietary and multi-point matching algorithms allow even the most basic user to understand the relationships and potential fraud exhibited by Chameleon Carriers.

-

Business Intelligence SolutionsOur vast data warehouse and development team can provide customized modelling and software integration solutions for your unique data requirements.

Business Intelligence SolutionsOur vast data warehouse and development team can provide customized modelling and software integration solutions for your unique data requirements.

-

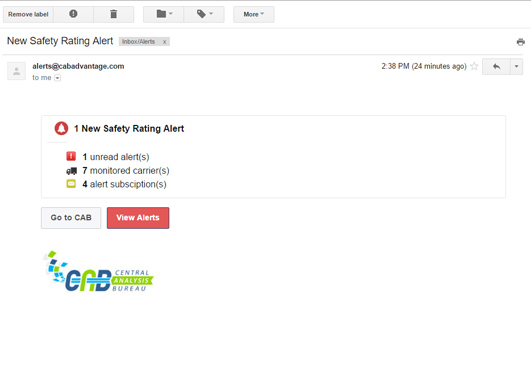

Monitoring ServicesBenefit from real-time alerts notifying you of critical changes to an account.

Monitoring ServicesBenefit from real-time alerts notifying you of critical changes to an account.

-

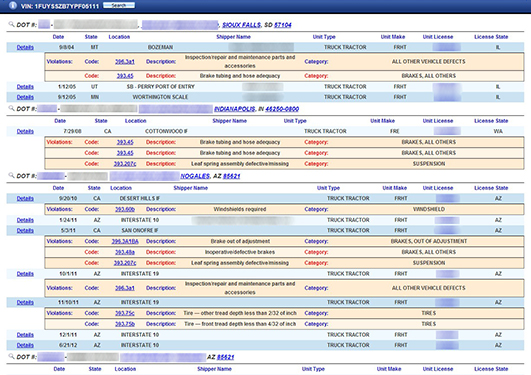

Vehicle TrackerSearch the expansive inspection, crash and violation history of vehicles and the motor carriers that operated them using as little as a partial VIN or license plate.

Vehicle TrackerSearch the expansive inspection, crash and violation history of vehicles and the motor carriers that operated them using as little as a partial VIN or license plate.

-

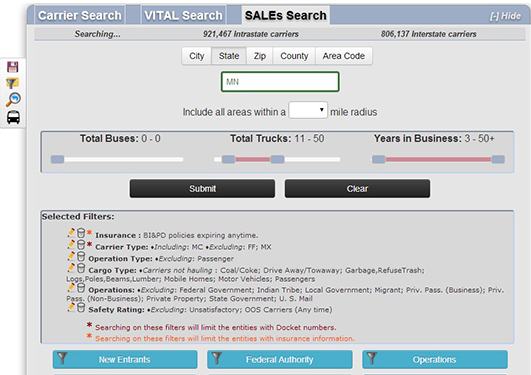

Sales LeadsWe offer the industry's most advanced leads generator providing you instant access to the most up to date list of motor carriers tailored to meet your exact operational, safety and geographic appetite.

Sales LeadsWe offer the industry's most advanced leads generator providing you instant access to the most up to date list of motor carriers tailored to meet your exact operational, safety and geographic appetite.

CAB Defining Innovation

75+ years of experience

Millions of safety records

One source